The Definitive Guide For Disability-Owned Business Enterprises

Disability-owned businesses are a growing segment of small businesses. Approximately one in five Americans have a disability, and people with disabilities are nearly twice as likely to be self-employed as people without disabilities. Get the definitive guide for these businesses.

We know that small businesses are a vital component of our economy. According to the U.S. Small Business Administration, there are nearly 30 million small businesses in the United States, accounting for a whopping 99.9 percent of all U.S. businesses, and eight million of those are classified as diverse businesses. These 30 million small businesses make a significant impact on our economy through job creation, innovation, and economic impact.

Disability-owned businesses are a growing segment of small businesses. Approximately one in five Americans have a disability, and people with disabilities are nearly twice as likely to be self-employed as people without disabilities.

1 in 5 Americans have a #disability, and people with disabilities are nearly twice as likely to be self-employed as people without disabilities.

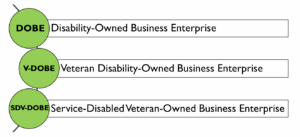

Corporations are realizing the importance of disability inclusion in their supply chains—so much that the Billion Dollar Roundtable (BDR) has expanded their criteria of diverse businesses that are counted toward a corporation’s supply chain spend. Diverse-owned businesses accepted by the BDR now include: certified disability-owned business enterprises (DOBEs), veteran disability-owned business enterprises (V-DOBEs), and service-disabled veteran-owned business enterprises (SDV-DOBEs).

Special classification is available for disabled veteran business owners, a growing sector in our economy. According to the Small Business Administration (SBA), veteran-owned firms had receipts of $1.14 trillion, employed 5.03 million people, and had annual payroll of $195 billion in 2012. Approximately 7.3 percent of those veterans reported having a service-connected disability.

Read on to learn more about what classifies a business as disability-owned and the resources available to certified DOBEs.

What Is a Disability-Owned Business?

There are three types of DOBEs: disability-owned (DOBE), veteran disability-owned (V-DOBE), and service-disabled veteran-owned (SDV-DOBE) business enterprises. A possible secondary certification as an 8(a) business may also apply. Check the requirements below to see which categories fit your business.

Disability-Owned Business Enterprise (DOBE) Requirements

A Disability-Owned Business is defined as:

- At least 51 percent of the business is owned by disabled individuals, or in the case of a publicly-owned business, at least 51 percent of the stock is owned by one or more such individuals, i.e., the management and daily operations are controlled by those minority group members.

- Disability is defined as a physical and/or mental impairment that substantially limits one or more major life activities.

Veteran-Disability Owned Business Enterprise (V-DOBE) Requirements

All DOBE requirements plus:

- Business is 51 percent owned, controlled, operated, and managed by a veteran, but disability was not incurred during their time of service.

Service-Disabled Veteran-Owned Small Business (SDV-DOBE) Requirements

The government limits competition for certain contracts to businesses that participate in the Service-Disabled Veteran-Owned Small Business program.

Joining the disabled veterans’ business program makes your business eligible to compete for the program’s set-aside contracts. You can still compete for contract awards under other socioeconomic programs you qualify for.

To qualify for the service-disabled veterans’ business program, your business must:

- Be a small business.

- Be at least 51 percent owned and controlled by one or more service-disabled veterans.

- Have one or more service-disabled veterans manage day-to-day operations and also make long-term decisions.

- Eligible veterans must have sustained their disability during their time of service.

NOTE: The SBA does not have a separate DOBE designation, however they do have a SDV-DOBE category.

8(a) Economically Disadvantaged Small Business Requirements

The federal government tries to award at least five percent of all federal contracting dollars to small disadvantaged businesses each year through the 8(a) program. To qualify for the 8(a) program, follow this eligibility checklist:

- Be a small business.

- Has not previously participated in the 8(a) program.

- Be at least 51 percent owned and controlled by U.S. citizens who are economically and socially disadvantaged.

- Be owned by someone whose average adjusted gross income for three years is $250,000 or less.

- Be owned by someone with $4 million or less in assets.

- Have the owner manage day-to-day operations and also make long-term decisions.

- Have all its principals demonstrate good character.

- Show potential for success and be able to perform successfully on contracts.

More information about small business categories can be found on the Small Business Administration’s website.

Becoming Certified as a Disability-Owned Business

If you meet the requirements to be a DOBE, V-DOBE, or SDV-DOBE, your next step is to become certified. There are two types of certification, although they are not equal: self-certification and third-party certification.

While self-certification is simpler than going through a third-party, many of today’s corporations prefer the latter. Third-party certification provides corporate supplier diversity programs the assurance that an independent, nationally-recognized agency vetted your company and verified your disability-owned status.

Self-Certification

Follow the Small Business Administration (SBA) online self-certification process. Use the link below to begin certifying your disability-owned business.

SDV-DOBEs can self-represent to the federal government as being owned by a service-disabled veteran by simply updating the socioeconomic status section of their business profile at SAM.gov.

Third-Party Certification

The Disability Supplier Diversity Program (DSDP) is the leading third-party certifier of disability-owned business enterprises (DOBEs), including service-disabled veteran-owned business enterprises (SDV-DOBEs). The program is administered through the Disability:IN, an organization that unites business around disability inclusion in the workplace, supply chain, and marketplace.

DSDP certifies DOBEs through a rigorous and highly credible two-year national certification process trusted by corporate America.

Education, Funding, and Contracting Resources

Education and Training

Fortunately, both government and private institutions realize the value of supplier diversity and are investing in supplier development. Whether you’re just beginning your business or you’ve been around a while, these educational resources are sure to help.

Disabled Businesspersons Association (DBA)

The DBA works to advance vocational rehabilitation and increase the competitive performance of the disabled in the workplace. The organization offers education, mentorship for both veterans and civilians, and a special youth-focused program to identify the next generation of leaders with disabilities.

Learn more about the DBA here.

Disability:IN

Disability:IN offers several opportunities for professional growth and networking. The annual conference brings together business owners, entrepreneurs, corporations, thought leaders, and high-profile speakers to learn more about succeeding as a disability-owned business.

The Rising Leaders Mentoring Program brings together employers and college students/recent graduates with disabilities, including veterans, in a six-month career mentoring opportunity.

Disability:IN has a network of nearly 50 Business Leadership Affiliates, representing over 5,000 businesses. These affiliates engage businesses of all sizes in networking discussions to increase their knowledge of community outreach, recruiting and interviewing, the accommodation process, and barriers to employment.

SCORE

For over 50 years, the nonprofit SCORE has been helping small businesses (including disability-owned) get off the ground through education and mentorship.

Because disability-owned businesses are supported by the SBA, they can take advantage of their services at no charge or at very low cost. Visit SCORE’s website to find more information on mentors, workshops, and other available resources.

8(a) Business Development Program

The 8(a) Program is a business assistance program designed specifically for small disadvantaged businesses. The program is government sponsored, highly involved, and has some inspiring success stories. Participants of the program go through a four-year developmental stage followed by a five-year transition stage. In addition to the nine-year program, participants have access to specialized business training, marketing assistance, and mentorship programs, to name a few. Find out how your 8(a) minority-owned business can participate here.

Funding

Access to capital is one of the main obstacles to business equality. The federal government offers several forms of assistance for DOBEs to secure funding through loans and grants, and thanks to the reach of the internet, crowdfunding has made access to millions of small investors easier to obtain.

Small Business Administration (SBA) Guaranteed Loans

One of the many resources the Small Business Administration provides is access to loans; however, the SBA does not loan money directly to small businesses. Instead, the Administration establishes loan guidelines with partnering lenders around the country. The SBA guarantees these loans will be paid, which means small businesses (like you) generally receive lower, more competitive rates and fees compared to non-guaranteed loans. Find more information about SBA-guaranteed loans.

USA.gov

Aside from the SBA, the United States offers other government-backed loans and funding resources. You can find more detail on how to get funding or grants for an 8(a) categorized business here.

Crowdfunding

As the name suggests, crowdfunding is used by businesses to pull small investments from a large number of investors – unlike traditional investments made by a handful of people. Many small businesses have found success exercising this type of investment strategy.

Crowdfunding sites have become an increasingly popular way to raise money for business ideas ranging from video games to backpacks to feature films to beehives. The SBA provides more detail on how to successfully crowdfund for your minority-owned.

Contracting Opportunities

Both the federal government and many of America’s top corporations require their procurement departments to spend a certain percentage on diverse suppliers every year. Once you are certified as a DOBE, it’s time to leverage that certification to gain access to contracting opportunities.

Supplier Registration Platforms

To streamline supplier diversity, blue chip firms invest in third-party supplier registration portals to streamline the buyer-supplier contracting process.

Free registration, seamless communication with potential buyers, and robust opportunity filtering are just a few features that a quality platform should provide to suppliers. Register your company today to start on the path toward working with Fortune 1000 companies.

Veterans First Contracting Program

The Department of Veterans Affairs, which awards a large amount of contracts to veterans, sets aside contracts for veterans through their Veterans First Contracting Program. Note that this program is not the same as the SBA’s program for SDV-DOBEs. To get access to set-aside Veterans Affairs contracts, your business must be verified through the Vets First Verification Program.

8(a) Business Development Program

Small disadvantaged business participants may be eligible for sole-source contracts, up to $4 million for goods and services and $6.5 million for manufacturing, through the 8(a) Program.

What may be an even greater aspect of the 8(a) Program is a participant’s ability to form a joint venture or team to bid on contracts. This gives 8(a) firms the ability to fulfill larger contracts that they may not be able to handle alone, while also developing industry relationships. Interested in learning more about the 8(a) Program and its requirements? Find that information here.

Historically Underutilized Business Zone (HUBZone) Program

The Small Business Administration created this program to assist businesses in economically depressed areas who often face greater business disadvantages.

While not restricted to minority-owned businesses, the HUBZone program can be a boon to your organization if you qualify. This two-minute video gives a quick overview, as well as details on how to participate in the program.